top of page

Search

La Bolsa, La Vida y Sin Frenos

Nuestro asesor robótico tradicionalista era tan efectivo como aburrido. ¿Cuál sería el resultado si desactivamos sus protocolos de...

H-Barrio

Sep 30, 2020

US Elections and VIX Term Structures

US elections are a major event for investors across the globe. US markets offer diversified and attractive opportunities to investors...

H-Barrio

Sep 30, 2020

¿La Bolsa o la Vida? (en Términos de Inversión)

Los consejos financieros tradicionales no están de moda. Las técnicas cuantitativas, el aprendizaje automático y una adopción más general...

H-Barrio

Sep 22, 2020

Of Momentum, Capitalization, Randomly Going for a Walk and Academic Confusion

Stocks momentum, reversal, capitalization and random walks.

H-Barrio

Sep 22, 2020

Trading Cryptocurrencies-Euro with QuantConnect´s Lean Engine

Officially QuantConnect´s Lean Engine does not support cryptocurrency trading in non-US dollar denominated accounts (yet). The procedure...

H-Barrio

Sep 18, 2020

Your Life In Overdrive

Our traditionalist robot advisor was effective and boring. What if we override its risk protocols and allow for some leverage in our...

H-Barrio

Sep 15, 2020

Your Life (In Investment Terms)

Traditional investment advice is falling out of grace. Quantitative techniques, machine learning, artificial intelligence and a general...

H-Barrio

Sep 8, 2020

The Automatic Dividend Growth Investor

The origins of Ostirion are in fundamental trading. Our past (and modest) successes came in the form of exhaustive fundamental analysis,...

H-Barrio

Sep 1, 2020

Predicting Volatility: Final Random Forest Model & All the Shots you Don't Take

Machine learning prediction of market volatility.

H-Barrio

Aug 25, 2020

Predicting Volatility: Support Vector and Random Forest Classifiers

Continuing with the development of our VIX predicting machine learning model we have adapted the model to the backtest engine in...

H-Barrio

Aug 18, 2020

Fractionally Differentiated Price as Feature for Machine Learning Models

Using fractionally differentiated price as a feature for machine learning. SPY predicting VIX in a machien

H-Barrio

Aug 11, 2020

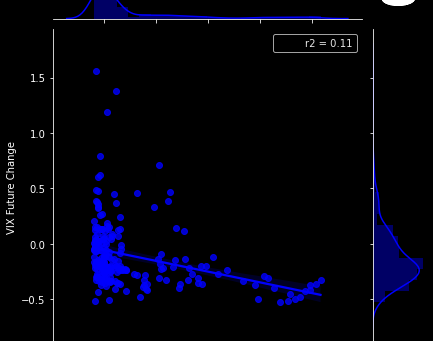

The Elusive Predictive Power of VIX

Trying to predict the stock market using VIX... or VIX using the stock market.

H-Barrio

Aug 4, 2020

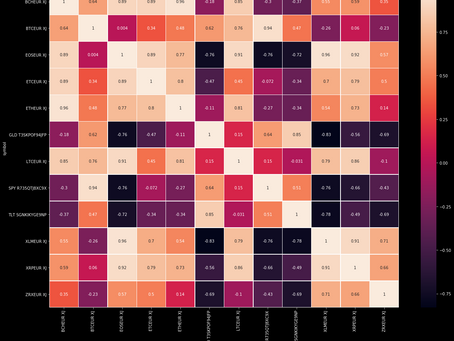

On Correlation among Cryptocurrencies and other Assets

Even if we here at Ostirion are not fans of cryptocurrencies we hold them and acknowledge their position as a hedge and diversification...

H-Barrio

Jul 28, 2020

Examples of Fractionally Differentiated Stock Price Series

One of the challenges of trying to predict the stock market prices using machine learning is the underlying assumption that the data used...

H-Barrio

Jul 20, 2020

On Risk Management and Pseudo-Diversification

Analysis of asset risk management through asset diversification.

H-Barrio

Jul 16, 2020

Simple Technical Analysis for Cryptocurrencies.

At Ostirion we do not like cryptocurrencies a lot, at the same time we acknowledge that these are a necessity to have in any well...

H-Barrio

Jul 13, 2020

Testing a Simple ARIMA Prediction Strategy

This past week we have been working on several traditional (simple, we could say) quantitative strategies looking for possible...

H-Barrio

Jul 7, 2020

Analyzing a Simple Mean Reversion Strategy

This post is inspired by a mean reversion strategy posted in Intrinio.com blog, here. We have made use of Intrinio data feed...

H-Barrio

Jun 30, 2020

Cats and Dogs in the Stock Market (V)

After checking that the predictive performance of our convolutional neural network was acceptably good we realized that these predictions...

H-Barrio

Jun 23, 2020

Cats and Dogs in the Stock Market (IV)

Now that we have a convolutional neural network that can discriminate if a day was bullish or bearish given trading information up to...

H-Barrio

Jun 17, 2020

bottom of page